Navigating Volatile Markets Through Long-Term Focus

Steve Wydler

Steve Wydler

Call us today and ask us, “Is now a good/bad time to buy/sell?” and you’ll get a lot of questions in return before you get an answer from our team. No, we’re not avoiding the question in favor of sales doublespeak. What we really need to know to be able to answer that question is: "Why?"

Market volatility is inevitable and, while uncomfortable, is beneficial and necessary to the market in the long term; it is its pressure release valve. Warren Buffet is quoted as saying “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes,” and the same holds true for home ownership. The fundamentals remain the same regardless of the market: don't look at your primary residence as an investment, get on the property ladder as soon as you can and, once you are there, stay put. If you buy a home and interest rates rise, you'll feel like a genius. If you buy and interest rates go down, you can always refinance. As the saying goes, "Marry the house but date the rate."

We look at market data not as an indicator of good/bad, yes/no, but as a guide for how we navigate our clients through the market as it exists at that moment in time within the context of their overall goals. Whether or not a home sale or purchase was "good" or "bad" isn't measured from the results of a home sale in a vacuum, rather it is in the context of how that purchase or sale fits into the long-term lifestyle wants and needs relative to financial goals.

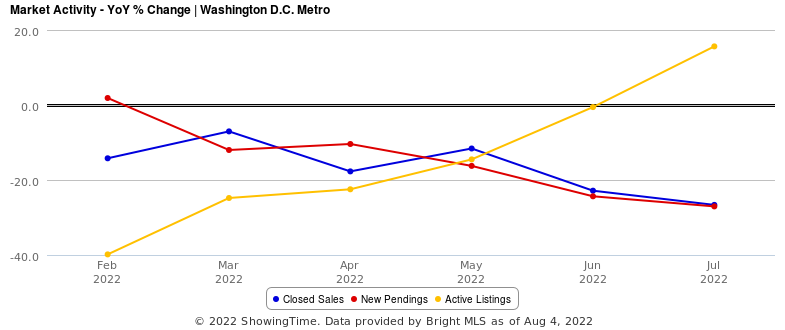

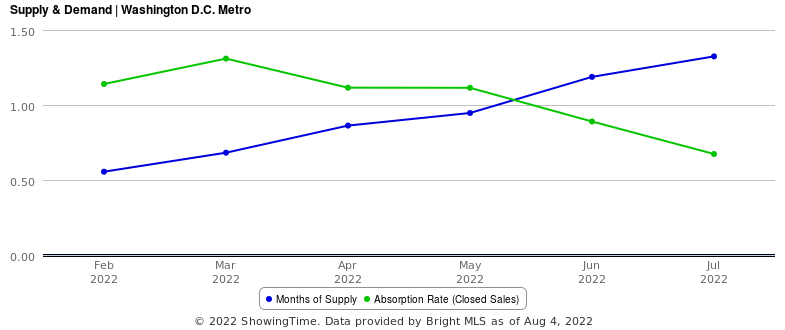

Buyers who had been through the wringer of the unprecedented tight and competitive pandemic market took a break this summer as rising interest rates took a chunk out of their affordability. Year-over-year, contracts (new pending) fell 27% from July 2021 over July 2022 while active listings rose 15.6% as homes sat on the market longer.

Sellers who were used to seeing their neighbors’ houses go under contract after 2 hours on market with 15 offers started to see houses still active after a weekend or, god forbid, two on market and price reduction alerts popped up in our inboxes for the first time in several years. Year-over-year, days on market increased 6.7% from July 2021 over July 2022.

We’re paying close attention to what (we think) will happen to interest rates, inventory, and home prices through the end of the year (stabilizing, increasing, and rising at a slower rate respectively) but these factors only matter inasmuch as they tell us how to get our clients where they want to be, not whether or not to take the journey at all. While the headlines around what is happening in the real estate market this year may seem sensational, the right time to buy or sell a home isn't when the market hits a certain metric, it's when it is right for you.

Stay up to date on the latest real estate trends.

Much has been written about the coming “Silver Tsunami” — the unprecedented wave of wealth transferring from Baby Boomers to younger generations. But from where we sit… Read more

As we look forward to this new year and enter a new housing market era, Steve and Hans have tackled 15 of the most common real-estate myths they see in the market.

Compass Corporate has released their 2026 Market Outlook, and a handful of insights stood out as especially telling. Here is what caught our attention.

Valuing and negotiating a home can feel a lot like blackjack. You need skill, instinct, and some luck—and the stakes are real.

We attended The 100 in Franklin, TN—an exclusive network of Compass’s top 100 agents nationwide—where we connected with peers and leadership representing over $30B in … Read more

October Market Update and the Year of the Crazy Ivan

After a summer of sweating through showings and pretending humidity is a glow, we’re savoring the cooler mornings, the first hints of gold in the trees, backpacks reap… Read more

It’s early August, but we think the market may be showing signs of … April vibes!

This Spring we were hoping our local real estate market would bloom. Instead, it pivoted.

Wydler Brothers have been selling residential real estate for over 20 years in the DC metro area. Along the way, they’ve achieved numerous awards and recognitions, including being recognized as “The Most Innovative Real Estate Agent in America” (Inman, 2014), written several articles for The Washington Post, authored a book, “Inside the Sell”, co-founded a real estate tech company which sold to Move, Inc. in 2013, and built Wydler Brothers into a highly respected boutique brokerage with 70 agents and employees which they sold to Compass in 2019. Currently, Wydler Brothers is among the top 3 teams in the DMV and was the #1 Compass Team in 2022.